Trigger warning: Death

A previous post explored the position that intended parents, surrogates and children may be left in if death were to occur on the new pathway, focusing on the allocation of legal parenthood. This blog will cover similar issues, focusing on the Law Commissions’ recommendations relating to the rules on succession and intestacy if death were to occur during or shortly after a surrogacy arrangement.

Succession rules determine an individual’s entitlement to the legal estate of a deceased person. In relation to surrogacy arrangements, succession rules will be important in instances where the surrogate or intended parent(s) die, in determining the surrogate-born child’s entitlement to the estate.

Under the current legal framework, the surrogate will be the child’s legal mother at birth and until a parental order is granted. Consequently, the automatic conferral of legal parenthood to the surrogate has been recognised by the Law Commissions as creating a legislative ‘gap’ where the surrogate-born child may inherit some (or all) of the surrogate’s estate, despite the surrogate assuming little to no legal or financial responsibility for the child after birth. It would also potentially not align with the surrogate’s intentions.

The Law Commissions have made recommendations for reform of the current legislation in England, Wales and Scotland. The recommended new pathway to parenthood would allow intended parents to be the legal parents of the surrogate-born child from birth. This would avoid the current ‘gap’ where the child could inherent from the surrogate (or their partner, if applicable).

This post provides further details on the intestacy rules, how they operate under the current framework and how the recommendations would overcome some of the concerns.

Current Law:

The rules on intestacy differ between England & Wales and Scotland, so each will be considered separately.

Inheriting from intended parents:

However, in both jurisdictions, the rules of intestacy as they apply to the intended parents are clear: a surrogate-born child would not inherit from the intended parents until the intended parents have become the child’s legal parents via a parental order. Of course, if the intended parents died testate, having made a valid will in which the surrogate-born child is provided for, the child would inherit in accordance with the will.

Inheriting from surrogate:

England and Wales:

In England and Wales, where a surrogate dies testate and has not made a provision in her will to leave any of her estate to the surrogate-born child, the child will not have any entitlement to the estate.

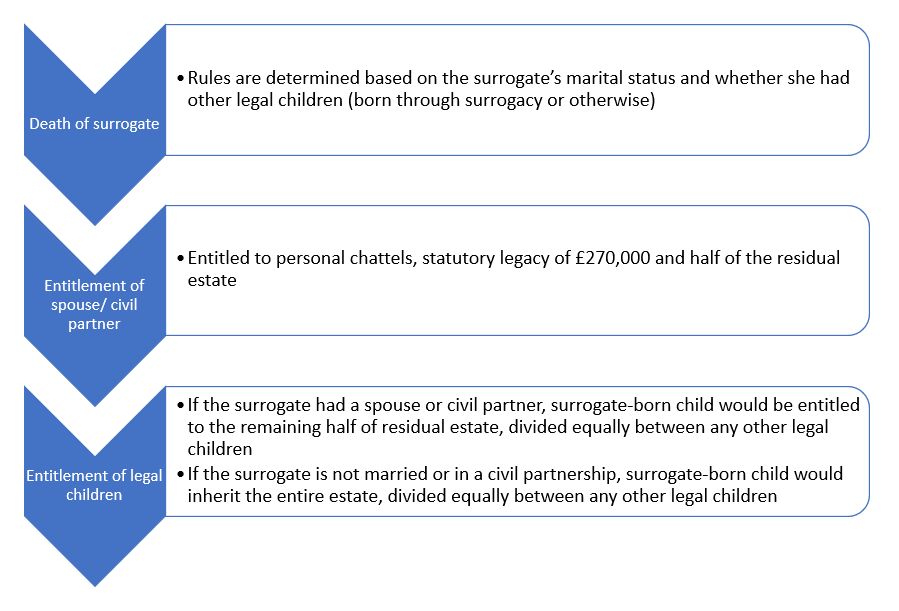

However, if the surrogate dies intestate, that is without making a valid will, or where her will does not completely dispose of her property, the law will follow intestacy rules. Intestacy rules establish who will inherit the deceased persons estate. The diagram below summarises the intestacy rules, which are determined on the basis of whether the deceased had a spouse or civil partner, and the number of children she had.

It is also important to note that inheritance entitlement operates as per the envetre sa mère (“in the womb of the mother”) principle (s55(2) Administrations of Estates Act 1925). This means that, were the surrogate to die before the child had been born, the intestacy rules would operate in the same way, meaning the surrogate-born child would inherit.

Scotland:

In Scotland, where a person dies testate, their estate is distributed in accordance with their will. However, prior to that distribution, children are entitled to ‘Legal Rights’ from the deceased moveable estate.

Moveable estate: consists of all assets of the deceased such as savings, jewellery, and investments, other than heritable property or land.

Legal Rights: an entitlement available to a spouse, civil partner and children of the deceased, no matter if they die with a will (testate) or without a will (intestate), to a share of the deceased’s worldwide net moveable estate. This is distinct to the Scottish jurisdiction.

The Succession (Scotland) Act 1964

A child’s entitlement to Legal Rights cannot be overruled by making a will. Therefore, until a parental order is granted a surrogate-born child, as the legal child of the surrogate, will always be entitled to legal rights in respect of the surrogate’s estate (or that of her spouse or civil partner). This, in turn, would reduce the estate remaining for distribution to the surrogate’s other children and family.

Where the surrogate dies intestate (without a valid will), and prior to the granting of a parental order, the child born will be the legal child of the surrogate and any partner, at the time of death. Resultantly, the surrogate-born child would be entitled to, amongst the other surviving children, part of the surrogate’s estate through Legal Rights, and thereafter a share of the free estate.

Similarly as in England & Wales, it does not make a difference whether the child was not born at the time of death, as succession rules treat an unborn child as if already born.

Therefore, whilst in England and Wales a surrogate could prevent the operation of succession rules from benefitting a surrogate-born child through making a will, the position is different in Scotland. Until a parental order is granted, the surrogate-born child would have an unwavering entitlement to the surrogate’s estate by way of Legal Rights or a share in legacy. This would most likely be contrary to the intention of the surrogate.

Inheriting from surrogate’s spouse or civil partner:

If the surrogate is married or in a civil partnership, the spouse would be treated in law as the child’s father until the time that a parental order is granted. As such, the surrogate-born child would also be able to inherit their property. The intestacy rules of England & Wales and Scotland, as outlined above, apply equally to the other legal parent where a parental order has not yet been granted.

Final Report Recommendations:

Inheriting from intended parents:

Given the recommendation for intended parents to become the legal parents of the child from birth under the new pathway, if the intended parent(s) were to die after the child was born, as the legal child of the deceased, the child would be able to inherit from the intended parent.

If the surrogacy arrangement is not on the new pathway, the surrogate would be the legal parent of the child, but so too may be one of the intended parents (through a genetic link or through application of the agreed parenthood provisions under the Human Fertilisation and Embryology Act 2008): if that intended parent were to die, the child could inherit from them as a legal parent.

The Law Commissions are additionally recommending that where an intended parent dies before the birth of the child, in a surrogacy arrangement on the new pathway, the child be treated as the legal child of the intended parent whilst in utero to allow them to inherit. It is important to note that this would not apply in cases where a parental order would be required, or where the arrangement ‘falls off’ the pathway. In those situations, the child would not inherit from the intended parent.

Inheriting from surrogate:

If the surrogacy arrangement is on the new pathway, and the surrogate does not withdraw her consent, the surrogate would never be the legal mother and therefore the child would not inherit from her. The recommendation as stated above, for the unborn child to be treated as the legal child of the intended parent, would also prevent inheritance rules applying to the child if the surrogate were to die before the birth of the child.

However, if the arrangement is not on the new pathway, or the surrogate withdraws her consent on the pathway, the surrogate would still be the legal mother and the intestacy rules would operate to benefit the surrogate-born child up until the point that a parental order is made in favour of the intended parents.

Inheriting from surrogate’s spouse or civil partner:

Finally, the Law Commissions have recommended that the surrogate’s spouse or civil partner would not be the legal parent of a child born through surrogacy, either under the new pathway or where the arrangement follows the parental order process. This means that the child will not be able to inherit from the estate of the surrogate’s spouse or civil partner.

Comments:

The rules relating to intestacy are complex, and can apply in a multitude of ways in surrogacy arrangements. This would be equally true under the Law Commissions recommendations as the operation of the rules would depend upon whether the arrangement was on the pathway or not.

What is clear is that the making of a will can avoid many of the uncertainties and complexities. The Law Commissions, whilst deciding against making it a requirement of the new pathway to make a will, have emphasised that Regulated Surrogacy Organisations should advise parties to the surrogacy arrangement of the importance of making adequate provision for dependents through a will.

Leave a comment